2026 Business Plan and Budget

On December 3, 2025, the 2026 Business Plan and Budget was adopted. Below are links to the Mayor's Directions and media release regarding the budget adoption:

The Business Plan and Budget are guided by the Town's Strategic Plan.

Multi Year - Council develops the Strategic Plan to guide the direction of the corporation for the 2022-2026 term of Council. It provides overall direction to guide decisions, projects, and initiatives undertaken during the term.

Multi Year - Council develops the Strategic Plan to guide the direction of the corporation for the 2022-2026 term of Council. It provides overall direction to guide decisions, projects, and initiatives undertaken during the term.

Annually - Staff will integrate the strategic priorities into the Annual Business Plans and Budgets. This annual review will ensure that work plans remain in alignment with Council’s strategic priorities.

Weekly/Daily - Departmental and individual work plans define the specific steps that staff will take to advance strategic objectives and measure progress while ensuring efficient and effective use of resources.

2026 Business Plan and Budget

The 2026 Business Plan and Budget contains four main components. Components 1 through 3 represent the budget to support Town operations. These budgets are for the recurring expenditures or revenues that the Town can anticipate each year. These include items such as salaries and benefits, materials and supplies, and fees and charges. Component 4 contains the budget details for the one-time or project specific expenditures.

Component 1 - Tax Supported Budget

The Tax Supported budget represents the component of the Town operations that is primarily funded through property taxes. Although some of the services are offset by fees and charges, there is an element of taxation revenue required to support each of these departments.

Component 2 - Development and Fee Supported Budget

The Development and Fee Supported budget represents the component of the Town Operations that is supported by fees for service (no tax support). There are five service areas that are included in this budget: Building, Planning, Development Engineering, Park Development, and Fill Operations. Each of these service areas has approved fees or charges that are intended to fully recover the cost of providing the service.

Component 3 - Water and Wastewater Budget

The Water and Wastewater budget represents the component of the Town operations that are supported by fees for service (no tax support). The Town charges water and wastewater fees to property owners based on water used. The annual fees are intended to ensure that there is full cost recovery to the Town for providing safe drinking water and maintaining the water and sewer infrastructure.

Component 4 - Capital Program Budget

The capital budget primarily represents projects or initiatives that are one-time or time specific in nature. The budget may include projects such as the construction of new sidewalks, facilities or sport courts. This project also includes the Town's annual repair and replacement program for maintaining the Town's assets. Although the annual repair and replacement program is required each year, the individual projects and related amounts of funding will vary annually depending on the program requirements in that year. The annual repair and replacement program may include road resurfacing, sidewalk maintenance, or computer replacement.

Appendix

Contains a glossary outlining operating expenditure and revenue categories used for budgeting purposes.

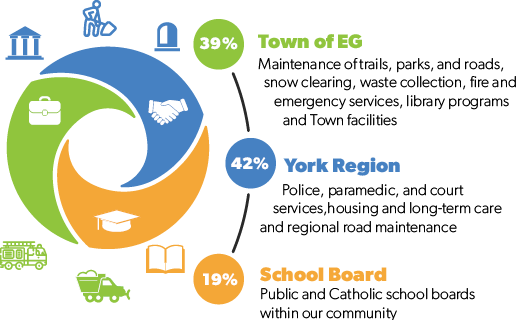

Where does my tax dollar go?

The below infographic shows the breakdown of where you tax dollar goes. To learn more about the departments that are supported by the EG portion of property taxes, please visit the Town Administration page.

Contact Us

Our Customer Service Team is here to help!